Have you ever had a bad experience with a car insurance company? Did they value your money but devalue your business? A good auto insurance company provides more than just a reasonable rate. They extend top-notch customer service from quote to claim. There are many things to consider when settling on the right company. Take a look at some reference points for choosing the best car insurance company.

Referrals

Multi-media advertising and word of mouth are great methods to consider when buying goods and services. However, when it comes to an auto insurance company, you should also consult rating companies such as A.M. Best to give you a top referral.

Three key factors that rating companies research are:

Three key factors that rating companies research are:

- How efficiently a car insurance company files claims.

- How long it takes the insurance company to receive a claim approval.

- Overall customer service.

View your state insurance commissioner’s website and search for possible reviews and complaints on local auto insurance companies.

Online shopping

Operating expenses for cars can be costly, so take some time to research comparable rates from multiple insurers.

Operating expenses for cars can be costly, so take some time to research comparable rates from multiple insurers.

Two things to remember:

- Don’t underestimate the ability of small insurance companies. Their rates will probably be more inexpensive than their larger competitors.

- An independent broker can do the heavy lifting online for you too.

Personal responsibility

Maintaining a high level of personal responsibility can get you a lower premium and give you headache-free ways to manage car insurance policies and payments:

Maintaining a high level of personal responsibility can get you a lower premium and give you headache-free ways to manage car insurance policies and payments:

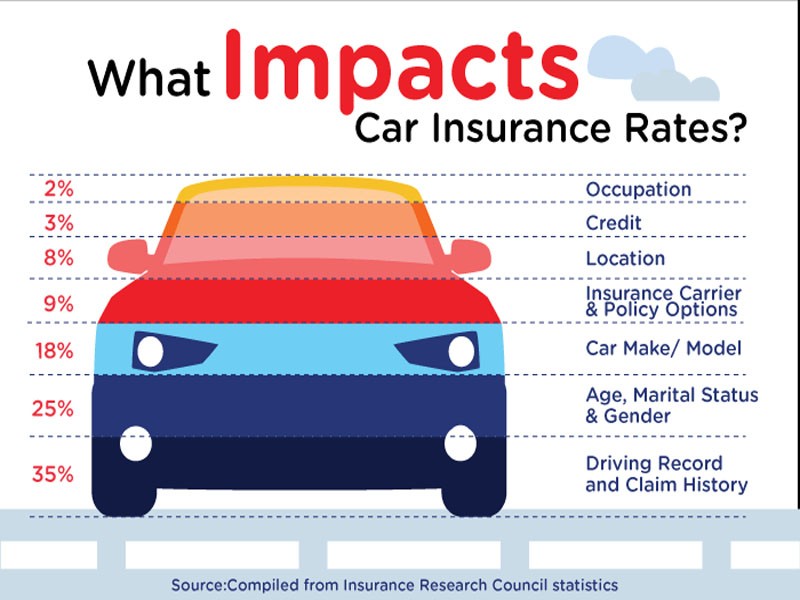

- Keep a good credit score. A low score may impact your premium.

- Report any reduction in mileage. If you have changed jobs, are working from home or are unemployed, you may qualify for a lower premium.

- Take advantage of discounts that are available for drivers. Lower risk drivers such as those who are older, married or who possess long safe driving records are eligible for lower policy costs.

- Safety and anti-theft equipment can reduce your cost.

- Bundling your home and auto insurance is another option to consider.

Choosing the right vehicle can also impact your car insurance prices. For your next car selection, contact Mike Duman Auto Superstore to view their inventory and find the right vehicle for you.